Seth Klarman is a value investing giant who draws comparisons to Warren Buffett and is one of the most successful hedge fund managers still working today.

His firm has amassed $30 billion in assets under management through the end of 2016.

But it's hard to follow Klarman since he is so reclusive. The investor did, however, share his top insights and strategies in a rare talk during the worst of the financial crisis eight years ago to a small investing class.

The Baupost Group hedge fund manager, who generated tens of billions in gains for his clients over decades, spoke to a class at The Ben Graham Centre for Value Investing at the Richard Ivey School of Business in Ontario, Canada, on March 17, 2009.

Klarman started with the three key underlying pillars of his investing approach:

1. Analyze the potential for loss before gain: "You want to focus on risk before you focus on returns. … A lot of it is focusing on multiple scenarios, what can go wrong? How much can you lose?"

2. Absolute over relative returns: "The world is oriented to relative performance. Everybody is an asset gatherer. ... By contrast we think wealthy individuals and established institutions because of their risk aversion are interested in absolute returns. If you're focused on absolute returns the idea of losing people's money becomes fairly abhorrent. … Your goal is not to lose less, your goal is to try to make money all the time, protect capital on the downside and still do well enough on the upside."

3. Forget macro investing, instead focus on individual investment ideas: "Most of the investment world has a top down orientation. They think about how is the economy going to do? And how are foreign currencies going to do? How are interest rates going to do? … My view is that is incredibly difficult to do. I don't know anybody with a really good long-term demonstrated record of success of macro forecasting."

The investor then explained his selling strategy. He gave the example if his firm buys a stock at $10 that is worth $20, when it rises to $18 or $18.50 they sell it.

"We never hold on for the last nickel. I think you make a big mistake when you do that. We never assume something will go past its fair value," he said. "We'll let someone else make the last dollar or two. … We'll always sell too soon."

Klarman said the selling discipline allows him to rebuy a stock after it drops. It also helps him avoid the psychological damage of watching an unrealized profit disappear due to greed.

In similar fashion, the investor said his firm does not borrow money for investments to amplify returns. He does not want to be forced out of a promising position at the worst time.

"We don't use leverage. We never had margin debt in the history of the firm," he said.

Klarman's fund has reportedly generated annual returns of 16.4 percent and $22.6 billion in net profit for his clients since inception more than three decades ago through 2015. Baupost generated a "high single-digit" return in 2016, according to an investor letter.

Used copies of the hedge fund manager's investing book "Margin of Safety" still sell for nearly $850 online.

A YouTube video of the 71-minute Klarman talk had roughly 4,400 views as of Thursday.

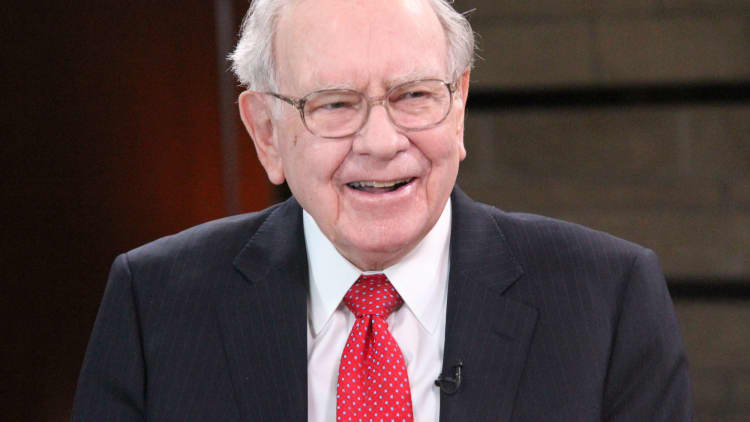

WATCH: How Warren Buffett makes long-term investments